What Is Regression Beta?

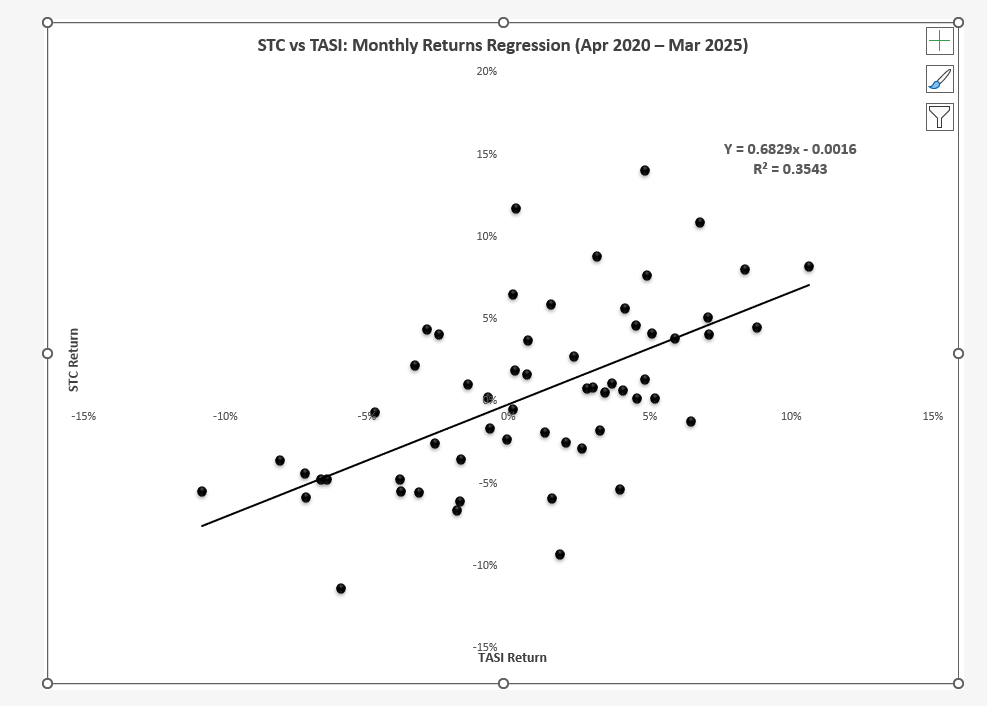

We ran a regression analysis on STC’s stock returns vs. TASI—the results reveal crucial insights about market risk in Saudi Arabia.

Understanding Regression Beta

Regression beta measures the sensitivity of a stock’s returns compared to the overall market. It’s calculated using historical stock and market returns:

Formula:

β=Covariance (Stock, Market)Variance (Market)\beta = \frac{\text{Covariance (Stock, Market)}}{\text{Variance (Market)}}

How to Interpret Beta:

- β = 1: Moves in tandem with market

- β > 1: Higher volatility than market

- β < 1: Defensive, less volatile

- β < 0: Rare, inversely correlated

📊 Case Study: Saudi Telecom Company (STC)

Overview:

- Stock: STC (7010.SR)

- Market Index: Tadawul All Share Index (TASI)

- Period: 60 months (monthly returns)

- Data Sources: Tadawul, Google Finance, Investing.com

- Tool: Excel Regression (LINEST function)

📊 STC Regression Beta Results

Metric | Value | Interpretation |

Beta (Slope) | 0.683 | Less volatile than the market (defensive stock) |

Alpha (Intercept) | -0.0016 | Slight underperformance |

R² (Goodness of Fit) | 0.354 | 35% of return variance explained by market |

CAPM Expected Return | 8.24% | With risk-free rate 5.17%, ERP 4.5% |

- 📈 Visual Representation

📌 Strategic Takeaways

- STC’s beta below 1 reflects its stable, telecom-driven revenue, positioning it as a defensive investment.

- Investors seeking lower volatility may find STC attractive for Saudi portfolios.

- Incorporate this beta in your Weighted Average Cost of Capital (WACC) calculations, adjusting leverage if necessary.

⚠️ Common Pitfalls in Beta Calculation

- Avoid short timeframes that introduce noise.

- Always use total returns, inclusive of dividends.

- Confirm the reliability with R² before trusting your beta value.

- Contextualize your data and understand underlying business dynamics.

Want the full Excel model?

Gain access to the exact Excel file used in this analysis, including formulas, trendlines, and return data.

🧐 Final Thoughts

Calculating beta doesn’t need complexity—it requires clarity. STC’s regression clearly demonstrates that precise modeling empowers smarter investment decisions.