Same Numbers, Different Futures

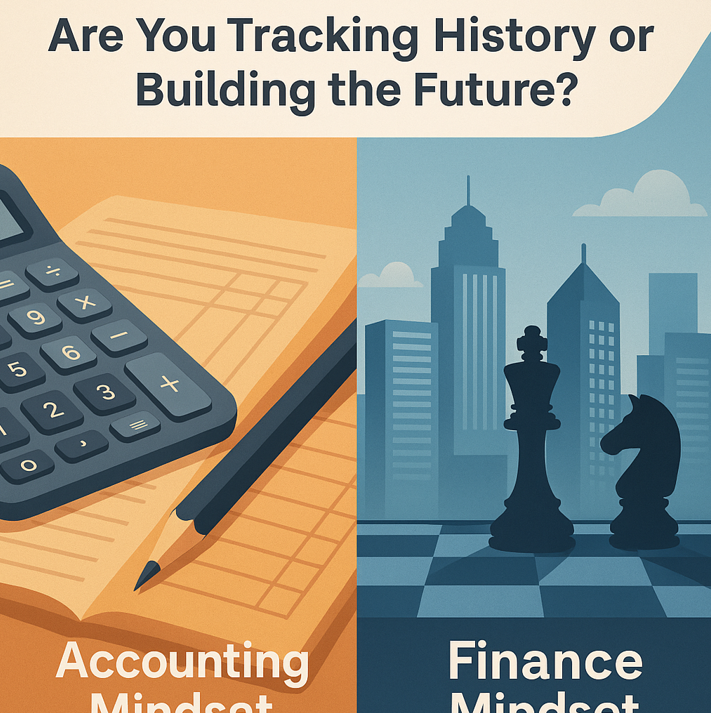

If you’ve ever sat in a strategy meeting, you’ve likely noticed it: accountants and finance professionals approach the same data with completely different intentions.

Where accounting ensures precision, finance fuels vision.

This post explores how these distinct mindsets affect business execution—and why adopting a Finance Mindset can be a game-changer.

The Accounting Mindset: Guardians of Accuracy

- Historical Tracking: Documents the past with factual clarity.

- Compliance Focus: Aligns reporting with standards like GAAP and IFRS.

- Reporting & Control: Maintains audit trails and stakeholder trust.

The Finance Mindset: Architects of the Future

- Strategic Foresight: Spots trends, disruptions, and opportunities early.

- Value Creation: Focuses on long-term ROI and competitive edge.

- Capital Efficiency: Allocates resources to maximize return and reduce risk.

Real-World Inspiration: Global and Local Case Studies

Tesla: Strategy Beyond the Balance Sheet

Tesla didn’t just crunch numbers—it committed to bold capital investments in battery tech, Gigafactories, and global expansion. The result? A transformation from niche to global icon.

Vision 2030: Finance Mindset at National Scale

Saudi Arabia’s Public Investment Fund isn’t just tracking assets; it’s deploying capital into megaprojects like NEOM and global investments to drive diversification, innovation, and leadership.

Bridging the Gap: Accounting + Finance = Strategic Power

Accounting gives you clarity. Finance gives you direction. Together, they create scalable, intelligent business strategy.

- Proactive Capital Efficiency

- Smart Risk Management

- Long-Term Strategic Decisions

- Innovation-Driven Growth

From Counting to Crafting Strategy: What’s Your Role?

👉 Are you using forecasts to guide real decisions?

👉 Has a Finance Mindset changed the outcome of a project in your company?